Advertised Differential Rates for 2023/2024

Consultation has concluded

Submission period now complete - this page will be archived by December 2023.

Please provide your feedback on the proposed Rate in the Dollar (RiD) and Minimum Payment for each Rating Category within the proposed budget for 2023/2024.

To generate the revenue needed to deliver the City’s activities, the cost is spread over all property owners (ratepayers) within the City of Kwinana. Rate revenue accounts for approximately 70% of the total revenue.

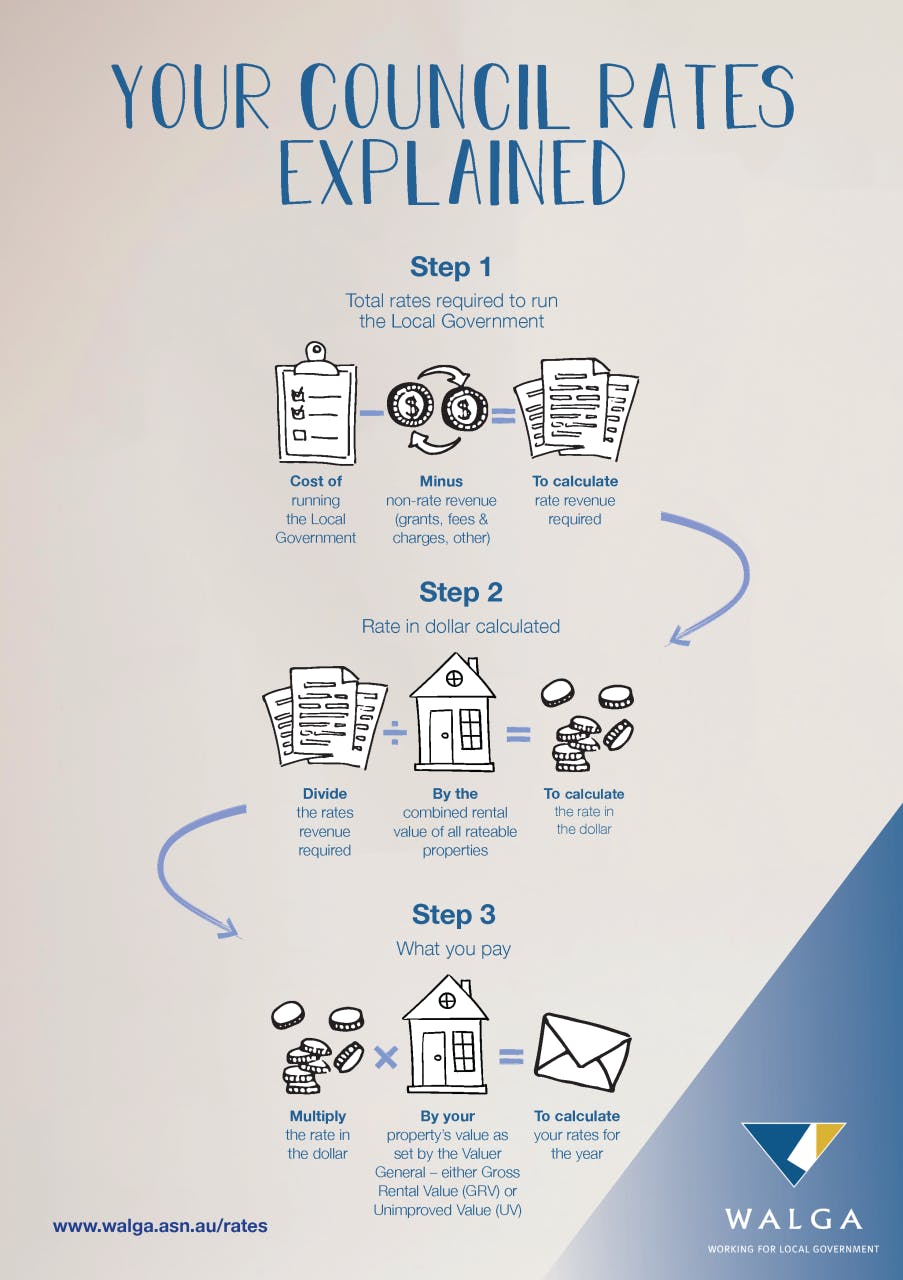

Rates are calculated by multiplying a property's valuation by the Council adopted RiD. How much your rates are depends on what Rating Category your property falls under and what value the Valuer General (Landgate) has placed on your property.

A RiD and minimum payment amount will be adopted in the 2023/2024 annual budget for each of the following Rating Categories:

- Improved Residential (including Improved Special Residential) (GRV)

- Vacant (including Vacant Non-residential) (GRV)

- Improved Commercial and Industrial (GRV)

- General Industry (UV)

- Rural (UV)

- Mining and Industrial (UV)

The rates are proposed to increase by an average of 3.95%, even though this is less than the Consumer Price Index figures of 7.8% for the December 2022 quarter and also less than the Local Government Cost Index which is forecast to be 4.5% for June 2023. Information on how each category is defined and determined can be found in the Statement of Objects and Reasons - 2023/2024.

The Valuer General (Landgate) provides all values for local governments in Western Australia. The most common type of valuation is called the Gross Rental Valuation (GRV) and is basically a fair rental annual amount. The other type of valuation is called the Unimproved Valuation (UV). The triennial valuation for GRV properties was received from Landgate dated, 1 August 2021, which may impact the rates on your property. Refer to the video on 'How is rates calculated' to give you further explanation.

The ratepayer should respond constructively to a request for submissions. In particular, the ratepayer should form a view as to whether the matters set out under the key values have been correctly addressed. Those key values are:

- Objectivity

- Fairness and Equity

- Consistency

- Transparency and Administrative Efficiency

These key values are explained in detail in the Rating Policy Differential Rates provided by the Department of Local Government, Sports and Cultural Industries.

The submissions received by the City will be considered by Council at the Special Council Meeting on 26 May 2023. This page will be updated with the results of the Council Meeting.

If you would like more information or to talk to a City Officer, please contact the City via the details on the Who's Listening section of this page.

The proposed Differential Rates and Minimum Payments for 2023/2024 are as follows:

| Rating Category Description | 2022/2023 RiD | 2022/2023 Minimum | Proposed 2023/2024 RiD | Proposed 2023/2024 Minimum | Variance |

| Improved Residential (including Improved Special Residential) | 0.10247 | 1,126 | 0.08947 | 1,170 | 4.16% |

| Improved Commercial and Industrial | 0.10222 | 1,466 | 0.18586 | 1,524 | 3.95% |

| Vacant (including Vacant Non-residential) | 0.18392 | 1,126 | 0.10212 | 1,170 | 6.71% |

| General Industrial | 0.01912 | 1,466 | 0.01943 | 1,524 | 3.97% |

| Rural | 0.00551 | 1,126 | 0.00506 | 1,170 | 3.84% |

| Mining and Industrial | 0.00920 | 1,466 | 0.00900 | 1,524 | 3.90% |